Do you know another name for savings clubs? Tell us on WhatsApp.

Ethical. Reliable. Radical.

In the UK, Didlum clubs used to be common among working class communities.

During the Windrush period (1948-1971), half a million people were brought to the UK to work from the Caribbean, but many racist banks and businesses refused to serve them. Pardna became a lifeline for families to afford homes, cars and businesses. Many of the millions of slaves that were trafficked from Africa to the Caribbean and Americas by the British and others had already used pardna to buy their freedom.

Sharing is a good idea. It enables common projects, brings individuals out of hardship and ties communities together. That’s why savings clubs appear again and again - even under the most difficult circumstances.

The Banker Ladies

Studies show that women are more likely to run and use savings clubs than men. Caroline Shenaz Hossein has researched these ‘Banker Ladies’ and produced a short documentary.

Why doesn’t everyone do it?

The first banks were groups of wealthy men who shared the gains of their lending business. Today, we’d call that a credit union. But as more people moved into cities, and money became more important, ordinary people wanted to put their wages somewhere safe. The wealthy bankers didn’t want to share the profits of the business with everyone so they distinguished between shareholders and customers.

In many societies, profiting too much at the expense of others or hiding away your private gain is seen as stealing from the community. In fact, many religions used to prohibit charging interest and some still do because of the effect it has on people, driving inequality and separation.

But in other places, it became common to think of all property as private, and to accept that in 2020 it would take an Amazon warehouse worker 8 weeks to earn as much money as Amazon CEO Jeff Bezos made in a single second.

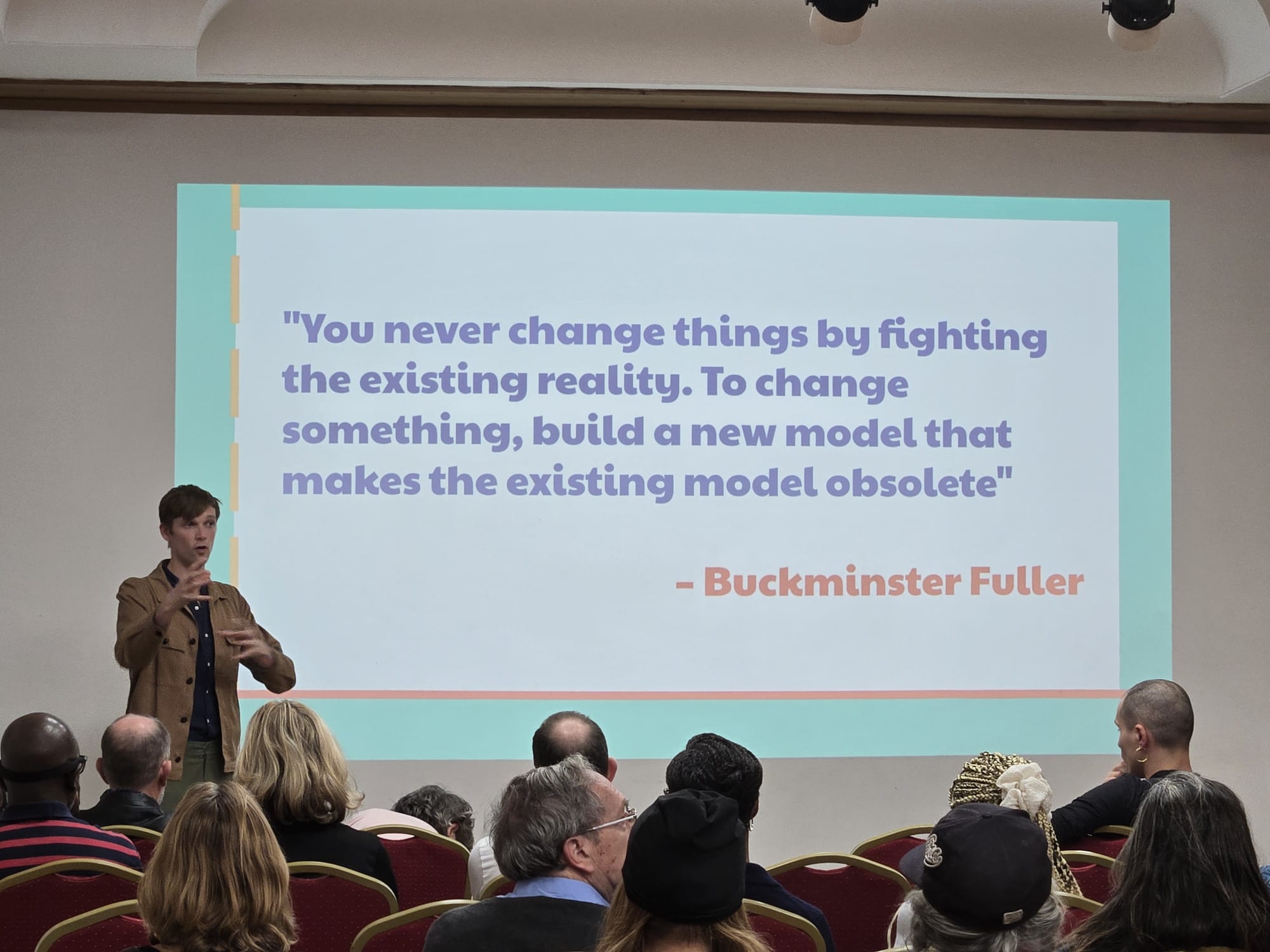

Change has never been more urgent.

Change has never been more urgent.

The everyone-for-themselves culture of hunting for the highest individual profits is driving inequality and harming our planet and climate. It works best for the largest corporations and their shareholders. Today, these are oil companies, weapons manufacturers, technology corporations and the wealth managers themselves.

While an obscenely rich few get even richer just for having money, the potential of so many human beings is diminished by unequal opportunities, and our ability to withstand crises together is reduced.

Our mission.

Kin was founded to change our financial culture by enabling members to start their own simple, safe, social saving clubs.

Our mission is enable communities to create more equal opportunities for their members, to manage resources together, to save towards shared initiatives including home retrofits, community solar, and the direct takeover of larger community assets. In brief, to create a community-led economic system based on care.

Imagine an economy where the engine that moves value around isn’t endless growth, which wrecks the planet, drives inequality and emboldens far-right demagogues.

Imagine people deciding where wealth and value is moved based on where it is needed and who needs it, reducing inequality but continuing to build amazing common projects.

Kin is the beginning. Invest in the people who will pick you up.